As the start date for repayment of the groundbreaking Saving on A Valuable Education (SAVE) income-driven repayment (IDR) plan nears, more than 4 million student loan borrowers have enthusiastically enrolled in the program in response to President Joe Biden’s ambitious initiative.

An unprecedented number of applications—nearly 1 million—have been submitted to the Department of Education since the online form’s soft launch on July 30th, ushering in a new era of hope and financial relief for millions of Americans burdened by student loan debt.

Most borrowers had little trouble making the changeover from the Revised Pay as You Earn (REPAYE) plan to the SAVE plan.

The federal agency has made an extraordinary outreach effort by personally contacting roughly 30 million borrowers to encourage them to sign up for the revolutionary SAVE Plan and make use of the new IDR application. This massive reaction offers a ray of hope for people who are drowning in student loan debt.

The Promise of the SAVE Plan

The SAVE plan, appropriately named to reflect its potential impact, has the potential to greatly reduce the financial stress of a large number of people. It claims to be able to decrease monthly costs in half for debtors by reducing payments to zero.

The White House has proclaimed that this will result in significant savings for individuals who make payments, with possible annual savings of at least $1,000.

The Supreme Court’s decision to invalidate former President Biden’s student loan forgiveness proposal served as the impetus for the creation of the SAVE plan. Those with yearly incomes of less than $125,000 (or $250,000 as a couple) were eligible for loan forgiveness of up to $10,000 under the original scheme.

Furthermore, it provided up to $20,000 in relief per borrower for those who had utilized Pell Grants throughout their time in higher education, erasing a staggering $441 billion in outstanding student debt.

The Words of Secretary Cardona

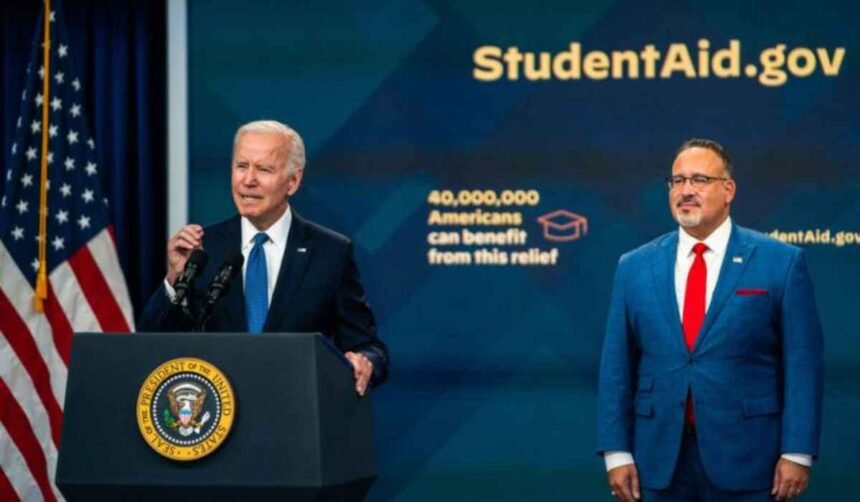

Secretary of Education Miguel Cardona exclaims, “I am thrilled to see so many Americans submitting applications every day so that they, too, can take advantage of the most affordable student loan repayment plan in history.” Millions of borrowers have already benefited from enrollment in the SAVE plan.

President Joe Biden has made it a priority since taking office to lessen the financial strain of student loans on middle-class families, and that effort will continue.

The sentiments expressed by Secretary Cardona reflect the desires of countless borrowers who have been waiting for a long time for a workable solution to their student loan problems. The Department of Education is making every effort to ensure that borrowers are aware of the benefits of enrolling in the SAVE plan, so signing up takes very little time.

The takeaway is unmistakable: by participating in SAVE, millions of people can cut their monthly student loan payments and save more than $1,000 each year.

Private Loan Holders: Exploring Alternative Paths

However, while private student loan holders will not be automatically enrolled in a federal income-driven repayment plan, the SAVE plan presents a significant opportunity for borrowers of federal student loans. This is not, however, the final chapter in their story. Borrowers with private loans should look elsewhere for financial relief.

Loan refinancing is one option, as it can help borrowers get a better interest rate on their current loans. Private loan borrowers may be able to reduce their interest rates and monthly payments by refinancing with a trustworthy lender.

Credible is a helpful tool for this because it allows users to research their loan refinancing possibilities from several lenders without damaging their credit score.

The SAVE proposal is a shining light of hope in a world dominated by rising student debt, giving millions of people a fighting chance to take back their financial destiny.

President Biden’s goal of lessening the strain of student loan debt on American families is becoming closer to reality as enrollment numbers rise.