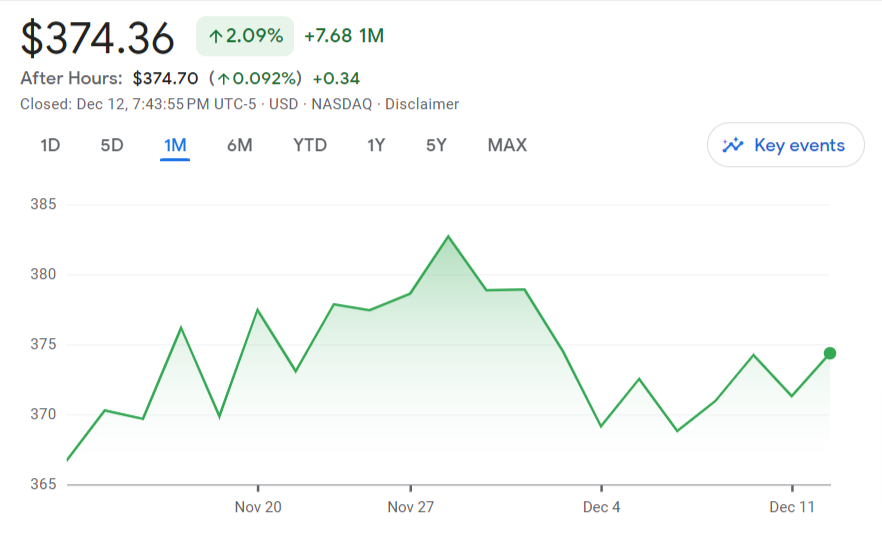

In the last 30 days, the stock of Microsoft—the tech behemoth responsible for Windows, Office 365, and Azure cloud services—has climbed more than 4%. On the other hand, with free cash flow predictions for the future approaching $100 billion, many experts think the stock is still cheap.

Free cash flow measurements, not the more conventional price-to-earnings ratios, were used to determine Microsoft’s valuation in a recent study. According to this research, Microsoft stock has the potential to increase in value by 39%, reaching $518 in the next 12 months.

“My target price is based on Microsoft’s free cash flow and where it could rise in the next 12 months,” stated investing expert Mark R. Hake. Take the company’s $20.7 billion in free cash flow from the prior quarter as an example.

That accounted for 36.6% of total quarterly income, a 22% increase year over year. This means that free cash flow might reach $90 billion this fiscal year and $102 billion next year, for a total of $96 billion, as revenue grows.

Free Cash Flow Estimates Approaching $100 Billion

Microsoft earned $56.5 billion in the most recent quarter, which ended on September 30. Impressively, free cash flow accounted for 36.6%, or $20.7 billion, of that revenue. Microsoft generated $63.2 billion in free cash flow in the twelve months ended in September.

According to industry forecasts, Microsoft’s revenue will reach $243 billion in the fiscal year ending June 30, 2024, and $276.75 billion in the fiscal year after that.

Free cash flow forecasts of $90 billion for the next fiscal year and $102 billion for the year after that are obtained by applying the revenue projections to the free cash flow margin of 36.6%. Over the course of the following 12 months, that equates to free cash flow of around $96 billion.

If Microsoft’s projected yearly free cash flow of about $100 billion pans out, according to Hake, the stock will soar.

Microsoft Stock Worth 39% More Based on Cash Flow

According to Hake, Microsoft’s stock could see a 39% increase if the company generates $96 billion in free cash flow next year, which would put its value at a 2.5% free cash flow yield.

“Right now Microsoft has a $2.77 trillion market valuation and produced $63 billion in trailing 12-month free cash flow for a free cash flow yield of 2.28%,” Hake stated.

A market cap of $3.84 trillion would be justified if the anticipated $96 billion in free cash flow were to be invested at a slightly higher 2.5% yield. Compared to the present valuation, that is 39% greater.

The stock is currently trading at $374, so a 39% gain from here would put the price objective for the following year at around $518. Microsoft stock appears to be underpriced when considering future cash flow projections, even though it has already gained 30% in 2022.

Income Strategy for Microsoft Shareholders

While waiting for Microsoft shares to reach its $518 price objective based on cash flow, Hake suggests that existing shareholders trade options to create extra money. His recommendation is to short Microsoft put options that are now out-of-the-money and have expiration dates within the next few weeks.

“One way for investors already long Microsoft stock to earn income is to sell out-of-the-money put options set to expire just 3 weeks out,” Hake advises.

Take the current price of $1.95 for the $357.50 strike put option with a December 29 expiration date as an example. With three weeks to expiration, you can earn 0.545%, or 9.27% annually, by selling this put, which is 3% out-of-the-money.

In addition, Hake considered the $350 strike put with a December 29 expiration and a current trading price of $0.99. Assuming premium collection yields 4.8% annually, this represents 5% out-of-the-money downside protection and could be sold multiple times over the course of a year.

Microsoft stock falling below the short put strike price by expiration, leading to an obligation to purchase the shares, is the main risk to this options income strategy. But you can keep the exercise probabilities low by choosing out-of-the-money strike prices that are at least 5% lower than the stock price today.

Bottom Line: Microsoft Stock Worth Over $500

The 22% increase in free cash flow from the previous year’s quarter is proof that Microsoft has been fundamentally operating well. Over the next twelve months, Hake predicts MSFT stock may price at $518 per share, a 39% increase, if current cash flow trends hold.

Savvy If Microsoft stock rises in value, investors can protect their investment by selling out-of-the-money put options with a shorter expiration date. An additional source of revenue can be obtained using this options technique by capitalizing on the inflated premiums for negative insurance.

Buyers and holders of Microsoft shares, as well as sellers of cash-secured puts, stand to gain substantially on the company’s enormous free cash flow runway.