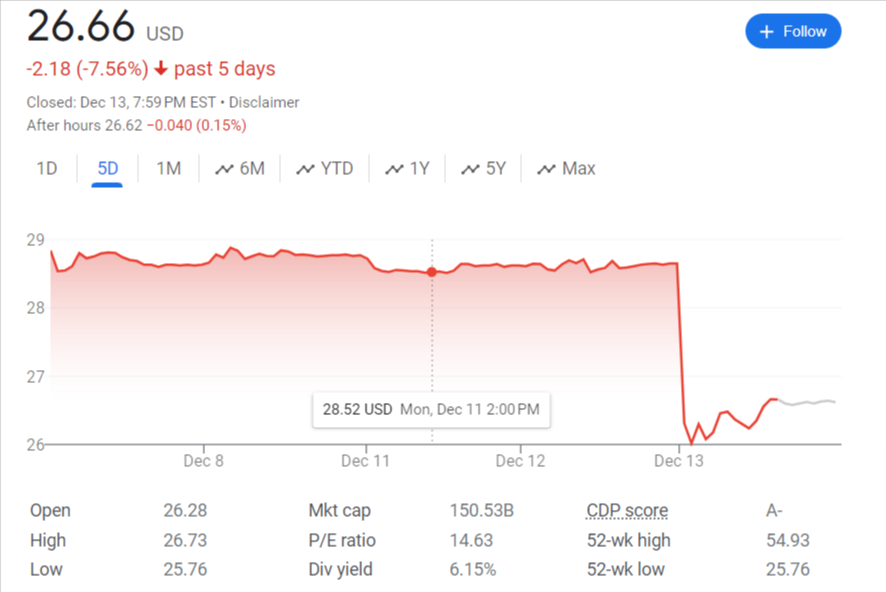

On Wednesday (13 December, 2023), pharmaceutical behemoth Pfizer stock fell more than 8 percent on the release of the company’s dismal revenue and profit forecasts for 2024.

Is Pfizer stock a good buy for dividend investors now that growth has slowed down because of declining sales of COVID-19 products?

Plunging COVID Product Sales Creates Big Hole

The fast dropping sales of Pfizer’s COVID-19 vaccination Comirnaty and antiviral therapy Paxlovid are a major reason for the disappointing guidance. After anticipating roughly $12.5 billion in 2023, the business predicts a precipitous decline to $8 billion in 2024 from the two goods.

This precipitous decline of 36% from the previous year has sliced Pfizer’s profit line in half. In 2024, the business projected total sales between $58.5 billion and $61.5 billion.

When contrasted to Pfizer’s expected revenue of $58–61 billion for the year, that range hardly accounts for the $3.1 billion from the impending acquisition of Seagen, suggesting virtually no total growth.

Earnings Projections Also Disappoint

Pfizer depressed investors with dismal profit forecasts in addition to dismal revenue projections. For the full year of 2024, the pharmaceutical behemoth predicts adjusted diluted earnings per share (EPS) of $2.00 to $2.25.

With the Seagen deal’s contributions factored in, this would be a drop from $1.45 to $1.65 in estimated earnings per share in 2023.

Operating revenue growth for Pfizer is projected to be 8-10% in 2024, even after adjusting for declining COVID-19 sales. However, stockholders obviously cannot turn a blind eye to the catastrophic impact on top and bottom lines caused by the rapid evaporation of revenue from Comirnaty and Paxlovid.

What Caused the Sharp COVID Product Decline?

COVID-19 vaccine by Pfizer An earlier stage of the pandemic saw tremendous success with the antiviral Paxlovid and the chemo drug Comirnaty. But there are a number of important reasons why demand has dropped significantly recently:

- Booster doses are not as urgently needed due to high global immunization rates.

- Infection rates are falling, leading to reduced demand for treatments like Paxlovid.

- Lack of robust, long-lasting protection makes repeat boosters sceptical.

- Vaccines and tablets from competitors are still gaining ground.

Because of these tendencies, sales of Paxlovid and Comirnaty have dropped dramatically. Pfizer appears to not anticipate an inflection point occurring soon, based on its 2024 estimate, as sales continues to fall significantly.

Is Pfizer Stock a Buy After 25% Drop Since August?

Shares of Pfizer fell more than 8 percent on Wednesday as a result of the gloomy growth forecast. The stock price has dropped by almost 25% from the end of August 2023. Is Pfizer still a good investment for dividend hunters in light of this steep drop in price and bargain valuation?

So says one group of experts. Income investors should be enticed by Pfizer’s low price-to-earnings ratio of approximately 10 and close to 6.3% dividend yield, even though the stock could be downgraded.

Nonetheless, there are those who believe that the stock is dangerous in the absence of more definitive positive catalysts due to the uncertainty surrounding COVID product demand and growth investments.

Until Pfizer can produce unexpectedly high profits, I don’t see the stock making a sustained recovery. It is unclear when those might happen. Despite any remaining weakness in the COVID product, Pfizer’s massive financial strength will allow it to maintain its large dividend distribution.

Once Pfizer overcomes the difficulties of comparing results from different years, it may be able to resume good growth thanks to its diverse portfolio that goes beyond COVID, its cancer biosimilars pipeline, and the synergies from the Seagen deal.

Buying Pfizer at 25% discount could be a wise decision for income investors with long time horizons. The likelihood of near-term gains is low, though, unless unexpectedly high profits materialize beforehand.

The Key Investor Takeaway

Opportunities abound at Pfizer’s pharmacy beyond the company’s dwindling COVID medicines. Future growth pillars include seagen and cancer biosimilars.

Nevertheless, barring unexpectedly good earnings catalysts, PFE stock is unlikely to recover sharply from the impending sales slumps of Comirnaty and Paxlovid.

However, Pfizer’s steadfastness, discounted valuation, enormous capital returns, and massive yield of 6% or more make it seem appealing to income investors.

Buying Pfizer’s large, well-covered payment on weakness could be a rewarding experience for those who can overlook the uncertainty of COVID products.