On December 10, 2021, Chicago Atlantic Real Estate Finance (REFI) stock was worth about $16.25 per share. If someone invested $50,000 in that stock, it would be worth $47,610 by January 31, 2024, when the stock was worth $15.87 per share.

Besides that, the trader would have made $9,722 from dividends on REFI Stock over the last 2 years.

Today, the $50,000 stake in 3,077 REFI stock is worth $57,332 after taking into account the capital gains and profits paid out. Over the next three years, this means a gain of 2.84% per year.

Chi-Ash Real Estate Finance is a real estate investment trust (REIT) that invests in business real estate loans. It gives most of its profits to its shareholders as dividends. This helps make REFI Stock an option that can bring in money.

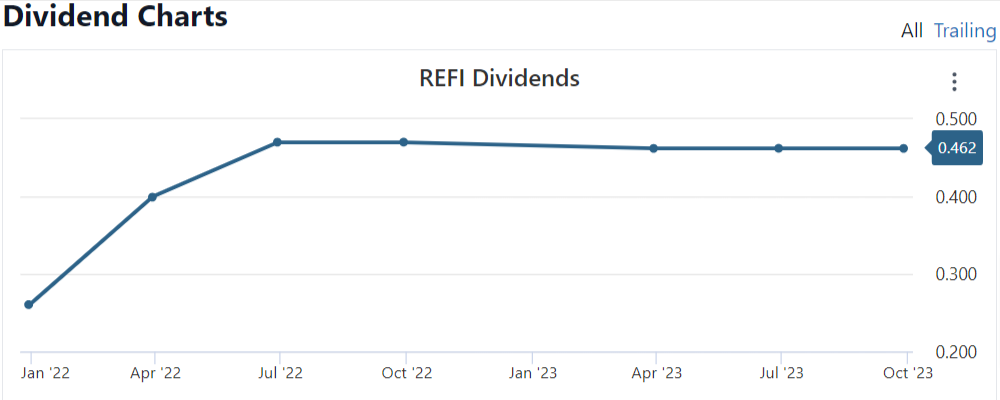

From the first quarterly dividend of $0.26 per share to the most recent one of $0.76 per share, REFI has grown its dividends by an amazing 193%. If you multiply this number by 12, it equals about 39% per year.

The REIT paid a yearly dividend of $1.04 per share in December 2021, when the shares were bought. The payout grew every year until it reached $2.62 per share in 2023. This means that dividend income went from $3,200 in 2021 to $8,062 in 2023 for the 3,077 shares in the $50,000 stock.

And since REFI Stock has a dividend payout ratio of 68.6% based on earnings in 2023, the income can continue to grow in the years to come as earnings rise.

REFI Stock has made a lot of money and added to its assets since it went public three years ago, but the share price has stayed unstable.

By the end of 2022, assets under management had grown from $75 million in 2020 to $3.1 billion. This was due to a high demand for business real estate loans.

Because of this, sales went from $11 million in 2021 to $49 million in 2022, and net income rose over 240% to $32 million last year. Because of this huge rise in earnings, Chicago Atlantic was able to quickly raise the dividend on REFI Stock.

So far, share price returns have been pretty low, but REFI’s high and quickly rising dividend has been good for investors who want to make money. If that investor had re-invested those profits, they could have also gained a lot more shares over time.

With a good chance to keep growing its lending portfolio and keeping portfolio yields in the double digits, REFI Stock looks like it will continue to reward shareholders through dividend growth and upside possibility as long as the company keeps doing what it’s supposed to do.

Dividend History

| Ex-Dividend Date | Cash Amount | Record Date | Pay Date |

|---|---|---|---|

| Dec 28, 2023 | $0.760 | Dec 29, 2023 | Jan 12, 2024 |

| Sep 28, 2023 | $0.4622 | Sep 29, 2023 | Oct 13, 2023 |

| Jun 29, 2023 | $0.4622 | Jun 30, 2023 | Jul 14, 2023 |

| Mar 30, 2023 | $0.4622 | Mar 31, 2023 | Apr 14, 2023 |

| Dec 29, 2022 | $0.760 | Dec 30, 2022 | Jan 13, 2023 |

| Sep 29, 2022 | $0.470 | Sep 30, 2022 | Oct 14, 2022 |

| Jun 29, 2022 | $0.470 | Jun 30, 2022 | Jul 15, 2022 |

| Mar 30, 2022 | $0.400 | Mar 31, 2022 | Apr 14, 2022 |

| Dec 30, 2021 | $0.260 | n/a | n/a |