Berkshire Hathaway, under the leadership of Warren Buffett, remains a cornerstone of diversified investment, demonstrating its resilience and profitability once again in the second quarter of the fiscal year 2024.

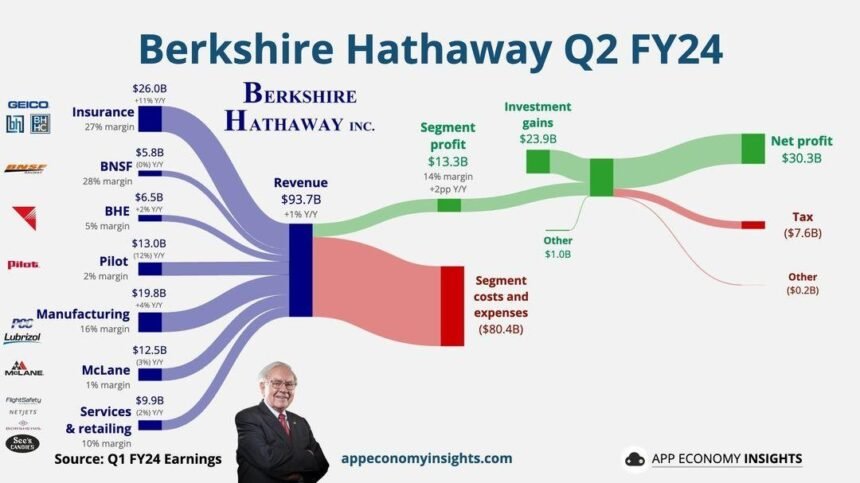

The financial performance for Q2 FY24, as depicted in the accompanying infographic from App Economy Insights, reveals a robust and multifaceted conglomerate, with significant contributions from various business segments.

Overview of Revenues and Margins

Berkshire Hathaway reported total revenues of $93.7 billion for Q2 FY24, reflecting a modest year-over-year (Y/Y) increase of 1%. This growth, albeit modest, highlights the company’s ability to sustain its revenue streams despite economic fluctuations.

The conglomerate’s diverse portfolio is a testament to its strategic investments across different sectors, mitigating risks associated with over-reliance on a single industry.

Insurance Segment

The insurance division, including GEICO and Berkshire Hathaway Reinsurance Group, generated $26.0 billion in revenue, marking an 11% Y/Y increase.

This segment boasted a profit margin of 27%, underlining its importance as a stable and lucrative component of Berkshire Hathaway’s portfolio.

Insurance operations have historically been a cornerstone for the company, providing substantial float income that fuels other investment activities.

Transportation and Energy

BNSF, the railroad operator, contributed $5.8 billion in revenue, maintaining its revenue levels with no Y/Y change.

The segment reported a profit margin of 28%, showcasing its efficiency and profitability. Meanwhile, Berkshire Hathaway Energy (BHE) reported $6.5 billion in revenue, reflecting a 2% Y/Y increase with a 5% profit margin.

These figures highlight the critical role of transportation and energy in Berkshire Hathaway’s diversified income streams.

Pilot and Manufacturing

Pilot, a leader in the petroleum sector, generated $13.0 billion in revenue, albeit with a 12% Y/Y decline. The segment’s profit margin stood at 2%, indicating the volatility in the energy market and its impact on revenue and profitability.

On the other hand, the manufacturing division, which includes companies like Lubrizol, McLane, and others, reported $19.8 billion in revenue, representing a 4% Y/Y increase and a 16% profit margin.

This segment underscores the strength and resilience of industrial operations within the conglomerate.

Retail and Services

The services and retailing segment, encompassing a diverse range of businesses, generated $9.9 billion in revenue with a 10% profit margin.

The consistency in performance from this segment highlights Berkshire Hathaway’s ability to capitalize on consumer-facing businesses and the steady demand in these markets.

Investment Gains and Overall Profitability

A notable highlight of the financial report is the substantial investment gains amounting to $23.9 billion. These gains significantly contribute to the overall profitability, reinforcing Warren Buffett’s reputation for astute investment strategies.

The segment profit, which includes these gains, totaled $13.3 billion, reflecting a 14% profit margin and a 2 percentage point Y/Y increase.

These figures emphasize the effectiveness of Berkshire Hathaway’s investment philosophy and its impact on overall financial health.

Costs and Expenses

Segment costs and expenses totaled $80.4 billion, demonstrating the scale of operations and the associated expenditures required to maintain such a diverse portfolio.

Despite these significant costs, the company’s ability to manage and mitigate expenses is evident in its overall profitability.

Net Profit and Tax Implications

After accounting for taxes amounting to $7.6 billion and other minor expenses totaling $0.2 billion, Berkshire Hathaway reported a net profit of $30.3 billion.

This figure underscores the conglomerate’s robust financial health and its ability to generate substantial returns for shareholders.

The effective management of tax liabilities and operational costs further accentuates the company’s efficiency.

Strategic Insights and Future Outlook

Berkshire Hathaway’s financial performance in Q2 FY24 showcases the strength of its diversified portfolio.

The ability to generate substantial revenues and profits across various sectors highlights the effectiveness of its investment strategies and operational management.

Key insights from this performance include:

- Diversification as a Strength: The diverse nature of Berkshire Hathaway’s investments mitigates risks associated with economic downturns in specific industries. This strategic approach ensures stable revenue streams and profitability.

- Investment Acumen: The significant investment gains underscore Warren Buffett’s and his team’s ability to identify and capitalize on lucrative opportunities in the market. This acumen continues to be a cornerstone of Berkshire Hathaway’s financial success.

- Operational Efficiency: The consistent profit margins across various segments reflect the operational efficiency and strategic management within the conglomerate. This efficiency is crucial in maintaining profitability amidst varying market conditions.

- Resilience in Insurance: The insurance segment’s robust performance, driven by GEICO and the reinsurance group, highlights the resilience and profitability of this sector. The substantial float income generated from insurance operations continues to fuel other investment opportunities.

- Challenges in Energy: The decline in revenue from the Pilot segment indicates the volatility and challenges in the energy market. However, the overall impact is mitigated by the diverse portfolio and other profitable segments.

Conclusion

Berkshire Hathaway’s Q2 FY24 financial performance is a testament to its strategic diversification, investment prowess, and operational efficiency.

The conglomerate continues to thrive under Warren Buffett’s leadership, generating substantial returns for shareholders and reinforcing its position as a cornerstone of diversified investment.

As the company navigates future economic landscapes, its diverse portfolio and strategic management will likely continue to drive its success and profitability.