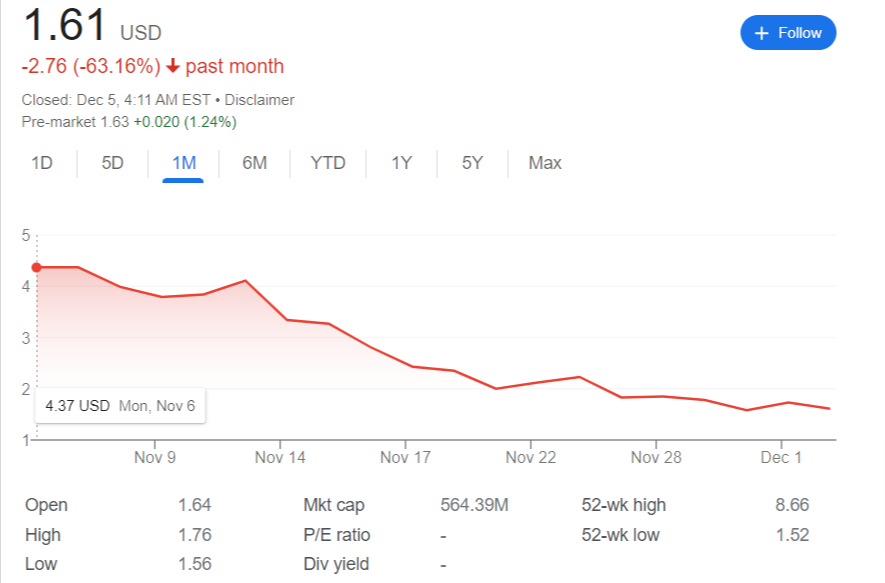

Shares of electric vehicle manufacturer Fisker crashed over 8% in trading on Monday after two Wall Street firms released eyebrow-raising reports that have investors wondering if this high-risk, high-reward stock is ultimately doomed or presents a contrarian opportunity.

Fisker’s Troubled Path

Once heralded as a potential juggernaut in sustainable transport, Fisker has faced no shortage of obstacles on its road to mainstream EV adoption.

The company recently backtracked on production targets for 2023, adjusting downward from 13,000-17,000 vehicles to just 10,000 units expected by year’s end.

2024 isn’t looking any less murky, with delivery delays likely to persist while cost projections have been dramatically scaled back.

After initially forecasting $174 million in 2024 earnings before interest, taxes, depreciation, and amortization (EBITDA), Fisker has returned to the drawing board with a far more conservative $103 million EBITDA estimate.

Evercore Drops the Hammer

Monday’s pessimistic pronouncements arrived courtesy of Evercore ISI analyst Chris McNally, who downgraded Fisker stock from Outperform to In Line, coupled with R.F. Lafferty’s Jaime Perez, who lowered his firm’s price target from $7 per share to $3.

In his downgrade, McNally pulls no punches, stating Fisker is on a “highly precarious tightrope of execution, brand risk, capital raises and dilution.”

He views the company as unable to compete with EV heavy hitters like Rivian and Lucid or category leader Tesla over the long haul, bluntly asserting “it’s time…to throw in the towel.”

Lafferty Offers a Counterpoint

Yet in the same breath that McNally appears to wave the white flag, Lafferty’s Perez keeps hopes flickering with a newly upbeat $3 price target. Perez’s figure stands 50% above Evercore’s $2 target and nearly 100% over Fisker’s current trading level. Lafferty also maintained its Buy rating on shares, stopping short of jumping on the doomsday bandwagon.

For Investors, a Question of Risk Tolerance

So in light of Monday’s conflicting opinions, what’s an investor to make of Fisker’s fortunes? It largely comes down to individual risk tolerance. On paper, Fisker fits the profile of a fading EV also-ran.

The company sports a roughly $600 million market capitalization against over $600 million of net debt. Profits remain nonexistent amid an overwhelming $800 million cash burn rate.

Yet most analysts foresee eventual profitability, with average 2025 EPS estimates hovering around $0.29 per share.

Given these projections, shares trade at a reasonable forward P/E of 5x. Of course, slipping timetables and scaled-back forecasts could quickly render these assumptions obsolete.

In Conclusion – Not Worth the Gamble

While a successful turnaround could multiply an investment several times over, I view Fisker as too precarious to justify at present, especially amid a weakening consumer environment less likely to support still-unproven EV offerings.

For those insisting on an EV gamble, Lucid and Rivian appear better positioned to capitalize on growth trends over the next decade. But prudence wins the day in my book – investors are best off avoiding this crashing stock plagued by delays, debt, and dilution.