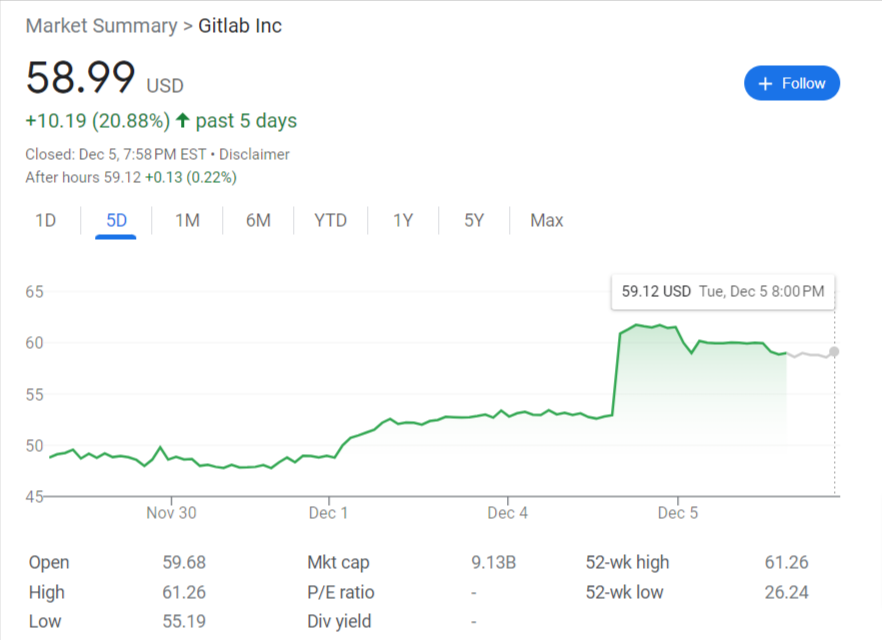

GitLab has done it again – blowing past expectations to deliver exceptionally strong fiscal third quarter 2023 results that sent shares of the DevSecOps platform provider rocketing up 13.5% Tuesday morning.

Propelled by broad-based customer adoption and retention along with substantial margin expansion and profitability improvements, GitLab’s beat-and-raise performance underscores the sustainability of the company’s growth trajectory.

With GitLab firing on all cylinders, there’s ample reason for investors to get excited about what lies ahead. Let’s dig into the details behind this quarterly earnings surprise.

GitLab Flexes Impressive Growth and Retention Metrics

GitLab’s revenue expanded 32% year-over-year to reach $149.7 million in Q3, handily surpassing estimates calling for $141 million. But it wasn’t just the top-line beat that stood out. GitLab saw new customer growth accelerate while existing customers demonstrated remarkable loyalty.

Specifically, GitLab grew its customer base generating over $5,000 in ARR by 26% to 8,175. Even more impressive, the number of customers producing ARR above $100,000 swelled 37% to 874. These metrics showcase GitLab’s ability to land larger enterprise deals while appealing to organizations of all sizes.

And on the retention front, GitLab’s dollar-based net retention rate climbed to 128% – indicating that existing customers spent 28% more on average compared to the year before. Between robust new customer acquisition and stellar retention of high-value accounts, GitLab has hit a powerful groove.

Bottom Line Pivots to Profitability

In another sign of GitLab’s momentum, the company’s bottom line underwent a radical transformation from loss to profit.

Whereas GitLab posted an operating loss of $21.6 million in Q3 2022, this time around it achieved an adjusted operating profit of $4.7 million. Likewise, on the net income line, GitLab swung from a year ago loss to reach positive adjusted net income of $14.4 million or $0.09 per share.

The ability to drive such substantial margin enhancement and profitability improvements gives credence to management’s focus on responsible growth. And with profitability coming well ahead of schedule, it unlocks strategic flexibility moving ahead.

CFO Brian Robins specifically cited the over 2,200 basis point increase in adjusted operating margin as evidence of GitLab’s profit focus amid top line expansion. Given the optionality this creates for investments in innovation and go-to-market while remaining sustainably profitable, expect profitability to energize GitLab’s outlook.

Guidance Raises Bar on Growth and Earnings

Bolstered by better-than-expected Q3 results, GitLab boosted its full-year guidance across the board. The company now expects:

- Revenue of $573 million to $574 million, up from $555 million to $557 million previously

- Adjusted operating loss of $10 million to $9 million, improved from -$33 million to -$30 million

- Adjusted EPS of $0.12 to $0.13, well above prior range of a -$0.08 to -$0.05 loss

Likewise, GitLab’s Q4 revenue outlook of $157 million to $158 million topped consensus at $150 million by a wide margin. The projected Q4 adjusted operating income of $5 million to $6 million and adjusted EPS of $0.08 to $0.09 also surpassed estimates for a slight loss.

With guidance raised across all key metrics, GitLab is signaling heightened conviction in its growth trajectory heading into year-end. Expect the momentum to carry through into 2024.

Key Takeaways: GitLab’s Flywheel is Spinning Faster

- Exceptional top line growth at scale showcases efficient customer acquisition

- Impressive retention and net retention spotlights stickiness of GitLab’s DevSecOps platform

- Substantial margin expansion and swing to profitability unlocks strategic flexibility

- Raised guidance confirms management’s confidence in growth and profit outlook

Powered by a flywheel of land-and-expand sales momentum and increasing profitability, GitLab’s growth narrative appears stronger than ever. It’s no wonder investors have again rewarded the company’s consistency with another post-earnings stock pop.

As GitLab continues scaling efficiently while posting bigger bottom line beats, expect shares to continue trending higher. With product innovation and sales execution hitting on all cylinders, GitLab has cemented itself as an enterprise software high-flier.