When stocks hit fresh 52-week lows, it often raises a dilemma for investors – are these battered names prime turnaround candidates offering value, or are they falling knives that will only slide lower?

Contrarians may view the deep discounts as an alluring opportunity, while more conservative investors see rising risks. We analyze some high-profile stocks at yearly lows to determine if their declines create a discounted chance or warn of more pain ahead.

The Conundrum of 52-Week Lows

In most cases, when a stock plummets to a 52-week trough, significant troubles are afoot. Equity valuations tend to reflect the latest available information, so drastic downward revisions typically indicate crumbling fundamentals.

However, for braver investors, the lure of possible 100% returns if a beaten-down name recovers to its former highs can prove irresistible.

As the old investing mantra says, buying low enhances later selling opportunities higher up. With stocks at yearly lows having already dropped precipitously, their downside could be limited even if more turbulence lies ahead.

For speculative traders willing to shoulder intensified risks, these unloved stocks may offer turnaround potential. However, bargain hunting in the rubble also raises chances of catching falling knives that only have further to drop.

1. Medical Devices Firm Hits the Skids

Becton Dickinson (NYSE:BDX) manufactures and sells medical technology products essential for healthcare and science fields. Its steady, defensive business helped shares trading largely sideways for years. However, a disastrous Q3 earnings report has sent the stock careening over 40% lower in 2022 to its present 52-week nadir near $215.

BDX whiffed massively on profitability metrics for the quarter. EPS plummeted 60% year-over-year to just $0.37, whereas analysts forecast over $3.40.Revenue also declined across multiple segments. With sales and earnings growth stalling, investors fled for the exits.

However, at 17.4x forward P/E, BDX now trades at a sizable discount to medical device peers. For investors betting on a reversion to normalcy, Becton Dickinson shares could offer turnaround value after being overpunished. But with macro headwinds still swirling, the bleeding may not be over yet.

2. Oil Giant Sideswiped by Falling Gasoline Demand

As a premier integrated energy supermajor, Chevron (NYSE:CVX) typically provides steady shareholder returns. But even big oil has proven vulnerable recently amid economic uncertainty and falling gasoline usage. Gas prices have now declined for over 60 straight days after hitting record highs earlier in 2022.

While drivers cheer the relief, Chevron and other hydrocarbon producers now face intensifying margin pressure.Weaker fuel demand also reflects growing economic angst among consumers. And China’s reopening still faces question marks.

Nonetheless, even with crude prices moderating, geopolitical tensions continue threatening supply reliability. Russia’s aggression and Middle East instability could quickly escalate to constrain global inventories once again. Hence, opportunistic investors may view CVX shares near $180 as oversold given the vital nature of its resources.

3. Gold Investment Struggles with Mixed Results

Franco-Nevada (NYSE: FNV) offers specialized exposure to precious metals as a gold-focused royalty and streaming corporation. This structure provides cash upfront to miners in return for ongoing shared revenue, allowing FNV to benefit from rising commodity prices without operating risks.

However, its stock has stagnated in recent months after revenue and EPS declined year-over-year in its latest earnings report. Weaker mining output dampened royalty intake amid gold weakness.

Nonetheless, analysts still forecast significant upside for FNV with a $152 average price target. Plus, upcoming inflation data could boost gold demand if prices accelerate higher again. Hence, the recent slide that has shares lingering at 52-week lows near $140 may mark an advantageous entry point. But FNV’s fortunes ride heavily on finicky gold prices.

4. Covid Vaccine Maker Confronts Life After Pandemic

Pfizer (NYSE:PFE) became a pandemic hero as one of the leading COVID vaccine manufacturers, catalyzing massive upside for its stock in 2020-2021.

However, 2022 has extracted a harsh reckoning as society moves past coronavirus troubles. With limited recurring revenue now expected from its mRNA products, shares have plunged by 25% over the last six months.

Q3 results affirmed Pfizer’s guidance reduction from September warning of growth struggles moving forward. Revenue and EPS both steeply declined as vaccine sales deteriorated further. Compounding matters, Pfizer also suffered key pipeline setbacks recently, with several promising drug candidates failing clinical trials.

But for extremely patient investors, Pfizer still wields strong development capabilities and a diverse product portfolio that could drive new catalysts over the long run. Its forward P/E now stands below 9x compared to 14x for healthcare peers. But near-term prognosis remains clouded for PFE stock languishing around $50.

5. Firearm Demand Normalizes from Pandemic Highs

Sturm Ruger (NYSE:RGR) manufactures popular handguns and rifles for sporting enthusiasts and self-defense. However, inventory backlogs have cleared significantly as consumers reconsider discretionary purchases amid inflation and recession fears.

In Q3, both revenue and EPS dropped by over 30% year-over-year. Firearm orders have normalized closer to pre-pandemic trends as excess demand gets saturated from past purchasing waves. Geopolitical and social unrest that stoked self-defense interest have also abated somewhat.

Nonetheless, Ruger holds prestige as an iconic American gunsmith. Plus, its ammo segment could help offset any lingering weakness for new firearm demand if consumers instead opt to replenish existing stockpiles. The pullback leaving RGR stock at $53 looks overdone relative to its reliable long-term role serving recreational and security markets.

6. Regional Cinema Chain Faces Attendance Declines

Headquartered in Milwaukee, Marcus (NYSE:MCS) operates popular multiplex theaters and hotels primarily targeting Midwest communities. Its focus on value pricing and service has fostered local patron loyalty in overlooked areas. However, movie attendance still faces pressures from in-home streaming competition and recessionary spending cutbacks.

Ad sales have slipped as studios delay major theatrical releases until more consumers return. Some analysts also consider its hospitality segment as overextended just as travel demand slows. No wonder MCS shares have crumbled more than 50% in 2022.

Yet its core cinema operations feature desirable real estate locations that serve essential small-town entertainment needs. Marcus also pays out an enticing 5% dividend supported by relatively stable cash flows.

For investors seeing light at the end of cinema’s tunnel, MCS stock below $15 could offer recovery upside. But a Wall Street-wide cold shoulder toward entertainment stocks validly signals ongoing disruption ahead.

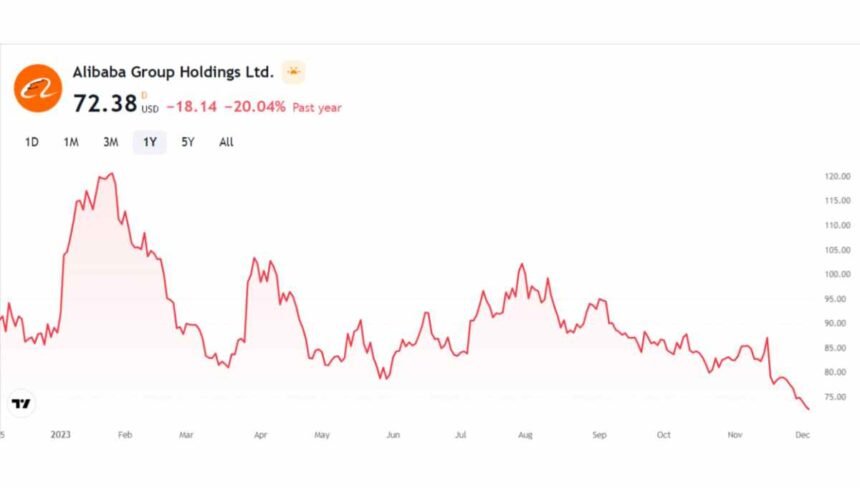

7. Chinese Tech Giant Brought Low by Economic Slump

As China’s e-commerce kingpin and a one-time Wall Street darling, Alibaba (NYSE:BABA) powerfully capitalized on the country’s meteoric rise last decade. Its shares ballooned over 700% higher between 2015 and late 2020. But now BABA languishes more than 80% below those peaks — a stunning fall for this formerly world-beating juggernaut.

Both China’s economy and its tech sector now face forceful headwinds. Regulatory crackdowns and geopolitical tensions have also plagued stocks like Alibaba. However, resilient domestic spending could offer a silver lining if Chinese consumers maintain steady discretionary outlays.

Currently near $80, BABA shares trade at just 8.3x forward earnings, their cheapest valuation ever beyond even March 2020’s depths.

For risk-tolerant investors trusting in China’s ultimate revival, Alibaba may offer extreme contrarian appeal after shedding nearly $600 billion in market capitalization. But true upside recovery remains years away until global confidence restores.