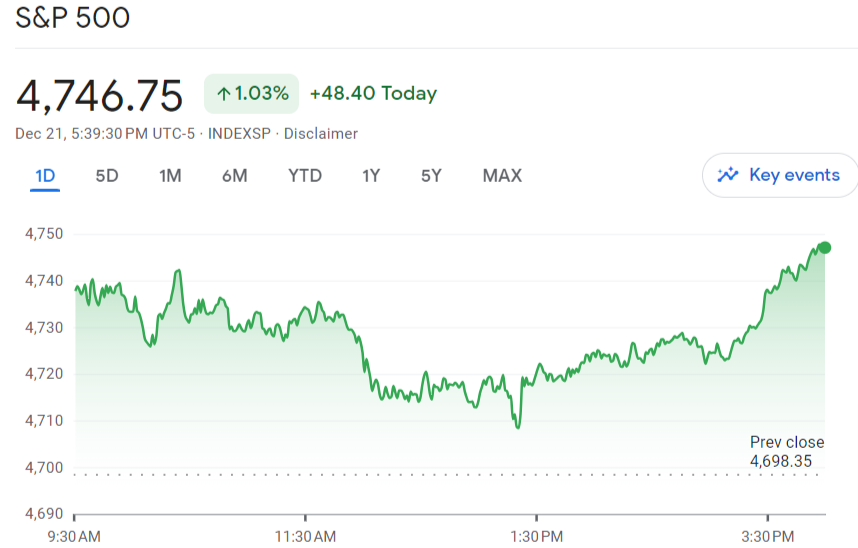

Thursday was a relief rally for U.S. stocks that helped them make up some of the ground they lost on Wednesday, which was the worst single-day drop in months for the major averages. Investors seemed to feel better after seeing signs of an improving economy, but they are still unsure about inflation and rate hikes.

With a 1% jump, the S&P 500 closed above 4,000, making up some of the 2.1% drop it took Wednesday. It took back some of its 613-point drop as the Dow Jones Industrial Average went up 208 points, or 0.6%. The tech-heavy Nasdaq Composite went up 1.2%, which was a bigger gain because buyers rushed back into growth stocks after the index fell 3%.

Better-than-expected numbers on GDP growth and the job market in the third quarter sparked the recovery. The Commerce Department’s final estimate for Q3 shows that the U.S. gross domestic product grew at a yearly rate of 2.9%, which is still a good rate but less than what was expected.

Also, the number of jobless claims last week was 205,000, which was lower than the 215,000 that was expected because the job market is still strong even though the Fed is continuing to tighten policy.

Bill Adams, chief economist at Comerica Bank, said, “The outlook for more rate hikes remains, but today shows the economy is holding up pretty well in the face of aggressive policy so far.” “Risks are still pointing toward a recession in 2023, even though the job market is strong and consumer fundamentals are strong.”

The price of Apple shares went down after the tech giant stopped selling some Apple Watches and accessories because of a patent case that was still going on. Juniper’s stock went up almost 25% after the company announced a $420 million military contract with the United States. Other semiconductor companies’ stock prices went up after Micron’s strong sales outlook suggested that the industry might be turning around.

Recently, the markets have gone up and down a lot because people are afraid that the Fed will tighten too much and cause a slump. After a strong rise since the middle of October, stocks fell this week after an inflation report that was much higher than predicted. There is still no clear answer to the question of whether or not business profits can handle higher rates and costs.

As the year comes to a close after a rough start, stocks seem stuck between two opposing ideas: on the one hand, hopes of rising prices and strong consumer demand; on the other, the actions of the central bank and a general lack of confidence. As unpredictability grows, daily market swings have become bigger.

For the economy, each small rate hike makes it more likely that growth will slow down as the cost of borrowing money for businesses and families goes up. But important things like the strong job market have stayed strong so far, which has kept fears of a recession at bay for now.

Thursday’s sharp rise shows that investors are still looking for deals while staying cautiously optimistic on the edges. However, many people think that trade will remain choppy and aimless through the winter. A lot will depend on the next reports on inflation and other policy signals from the Fed.

Commonwealth Financial Network’s Anu Gaggar said, “There are still a lot of questions that haven’t been answered going into 2023.” “Today’s gains are good news, but the volatility shows that worry and uncertainty are still present as the year comes to a close.”