Redwood Trust Inc. (RWT) is a real estate investment trust (REIT) focused on investing in residential and commercial mortgage-backed securities, loans, and other real estate assets. With shares trading below $10, RWT offers an attractive entry point for income-oriented investors.

Overview of Redwood Trust’s Business Model

Founded in 1994 and headquartered in Mill Valley, California, Redwood Trust operates through three primary business segments:

- Residential Mortgage Banking – acquires, originates, sells and securitizes residential mortgage loans. This segment represents the majority of RWT’s business.

- Business Purpose Lending – originates business purpose loans secured by residential real estate.

- Investment Portfolio – manages a portfolio of mortgage-backed securities and other investments.

By investing in mortgage-backed securities, RWT is able to generate steady income while taking on limited direct real estate risk. The REIT also originates and sells loans to generate fee income.

Recent Financial Results Reflect Ongoing Headwinds

Redwood Trust reported Q3 2023 results that fell short of Wall Street estimates, amid a challenging environment for mortgage REITs due to rising rates/recession fears.

Q3 adjusted EPS of -$0.11 missed by $0.45, while total revenue of $194 million undershot forecasts by $46 million. Book value per share decreased to $8.77, down 5% year-over-year.

Management noted pressure on gain-on-sale margins within the residential mortgage banking segment. Higher funding costs also weighed on results.

While financial performance has been lackluster recently, RWT entered Q4 with $3.7 billion of liquidity, providing a solid buffer to navigate further volatility. The dividend was maintained at $0.23 per share quarterly.

Why Redwood Trust Offers Value Under $10 Per Share

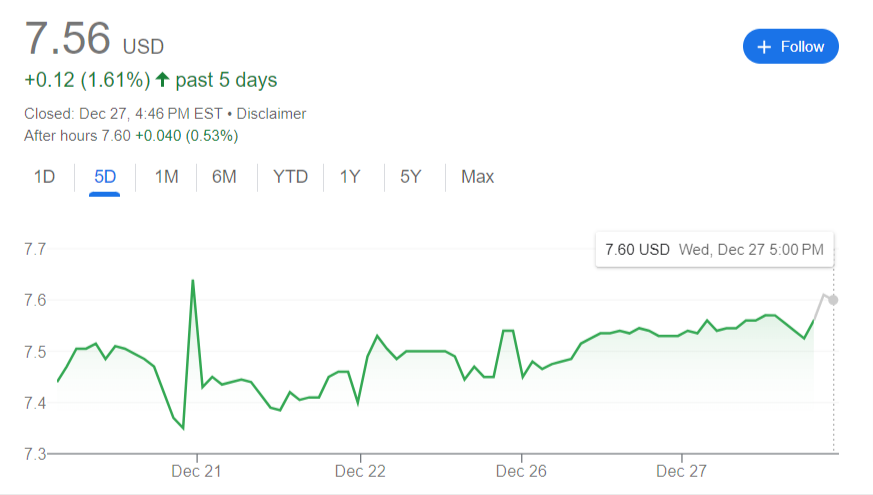

With RWT shares trading hands around $7.56 at present, the stock offers a compelling value proposition for income investors:

- High dividend yield – At $0.23 quarterly, RWT’s dividend yields 8.6% on an annualized basis. This is well above REIT averages.

- Discount to book value – RWT trades at a 15% discount to its most recently reported book value per share of $8.77. With book value expected to stabilize in 2024, upside potential exists.

- Growth anticipated in 2024 – For fiscal 2024, analysts forecast 43.6% bottom line growth and 19% revenue growth for RWT. If achieved, shares likely trend higher.

- Wall Street sees upside – The average analyst price target of $8.30 represents 11.6% upside from current levels. Out of 10 analysts, 9 rate RWT a “buy” or better.

- Improving macro backdrop? – As the Fed potentially slows rate hikes, mortgage REITs like RWT would benefit from stabilization in the housing market.

Bottom Line: RWT Offers Income and Upside Under $10

For investors seeking strong income, Redwood Trust presents an opportunity below $10 per share. The stock offers an 8.6% dividend yield backed by a solid balance sheet.

If RWT can return to growth in 2024 as analysts expect, the current valuation around 0.85x book value and 6.5x forward earnings looks attractive. Steady dividends plus double digit total return potential make RWT worth a look.