Realty Income (O), one of the safest real estate investment trusts (REITs) on the market, offers investors a tempting 5.14% dividend yield (as of 9th January, 2024) and the chance for a big price increase in till the end of 2024.

After an irrational 10% price drop last year due to negative sentiment in the real estate sector, Realty Income’s stock looks set for a big rebound. Its fundamentals are rock solid, and the company has been making good acquisitions that will add to its portfolio.

An Ultra-Reliable Monthly Dividend with 53 Consecutive Years of Payouts

Realty Income pays its owners every month, while most dividend stocks only do so every three months. Realty Income has paid out a monthly income for 642 months in a row, which is more than 53 years. This has happened no matter what the economy has been like.

Check Out Its Dividend History

| Ex-Dividend Date | Cash Amount | Record Date | Pay Date |

|---|---|---|---|

| Dec 29, 2023 | $0.2565 | Jan 2, 2024 | Jan 12, 2024 |

| Nov 30, 2023 | $0.256 | Dec 1, 2023 | Dec 15, 2023 |

| Oct 31, 2023 | $0.256 | Nov 1, 2023 | Nov 15, 2023 |

| Sep 29, 2023 | $0.256 | Oct 2, 2023 | Oct 13, 2023 |

| Aug 31, 2023 | $0.2555 | Sep 1, 2023 | Sep 15, 2023 |

| Jul 31, 2023 | $0.2555 | Aug 1, 2023 | Aug 15, 2023 |

| Jun 30, 2023 | $0.2555 | Jul 3, 2023 | Jul 14, 2023 |

| May 31, 2023 | $0.255 | Jun 1, 2023 | Jun 15, 2023 |

| Apr 28, 2023 | $0.255 | May 1, 2023 | May 15, 2023 |

| Mar 31, 2023 | $0.255 | Apr 3, 2023 | Apr 14, 2023 |

| Feb 28, 2023 | $0.2545 | Mar 1, 2023 | Mar 15, 2023 |

| Jan 31, 2023 | $0.2485 | Feb 1, 2023 | Feb 15, 2023 |

| Dec 30, 2022 | $0.2485 | Jan 3, 2023 | Jan 13, 2023 |

| Nov 30, 2022 | $0.248 | Dec 1, 2022 | Dec 15, 2022 |

| Oct 31, 2022 | $0.248 | Nov 1, 2022 | Nov 15, 2022 |

| Sep 30, 2022 | $0.248 | Oct 3, 2022 | Oct 14, 2022 |

| Aug 31, 2022 | $0.2475 | Sep 1, 2022 | Sep 15, 2022 |

| Jul 29, 2022 | $0.2475 | Aug 1, 2022 | Aug 15, 2022 |

| Jun 30, 2022 | $0.2475 | Jul 1, 2022 | Jul 15, 2022 |

| May 31, 2022 | $0.247 | Jun 1, 2022 | Jun 15, 2022 |

| Apr 29, 2022 | $0.247 | May 2, 2022 | May 13, 2022 |

| Mar 31, 2022 | $0.247 | Apr 1, 2022 | Apr 15, 2022 |

| Feb 28, 2022 | $0.2465 | Mar 1, 2022 | Mar 15, 2022 |

| Jan 31, 2022 | $0.2465 | Feb 1, 2022 | Feb 15, 2022 |

| Dec 31, 2021 | $0.2465 | Jan 3, 2022 | Jan 14, 2022 |

| Nov 30, 2021 | $0.246 | Dec 1, 2021 | Dec 15, 2021 |

| Nov 1, 2021 | $0.22854 | Nov 2, 2021 | Nov 15, 2021 |

| Sep 30, 2021 | $0.22854 | Oct 1, 2021 | Oct 15, 2021 |

| Aug 31, 2021 | $0.22805 | Sep 1, 2021 | Sep 15, 2021 |

| Jul 30, 2021 | $0.22805 | Aug 2, 2021 | Aug 13, 2021 |

| Jun 30, 2021 | $0.22805 | Jul 1, 2021 | Jul 15, 2021 |

| May 28, 2021 | $0.22757 | Jun 1, 2021 | Jun 15, 2021 |

| Apr 30, 2021 | $0.22757 | May 3, 2021 | May 14, 2021 |

| Mar 31, 2021 | $0.22757 | Apr 1, 2021 | Apr 15, 2021 |

| Feb 26, 2021 | $0.22709 | Mar 1, 2021 | Mar 15, 2021 |

| Jan 29, 2021 | $0.22709 | Feb 1, 2021 | Feb 16, 2021 |

| Dec 31, 2020 | $0.22709 | Jan 4, 2021 | Jan 15, 2021 |

| Nov 30, 2020 | $0.2266 | Dec 1, 2020 | Dec 15, 2020 |

| Oct 30, 2020 | $0.2266 | Nov 2, 2020 | Nov 13, 2020 |

| Sep 30, 2020 | $0.2266 | Oct 1, 2020 | Oct 15, 2020 |

| Aug 31, 2020 | $0.22612 | Sep 1, 2020 | Sep 15, 2020 |

| Jul 31, 2020 | $0.22612 | Aug 3, 2020 | Aug 14, 2020 |

| Jun 30, 2020 | $0.22612 | Jul 1, 2020 | Jul 15, 2020 |

| May 29, 2020 | $0.22563 | Jun 1, 2020 | Jun 15, 2020 |

| Apr 30, 2020 | $0.22563 | May 1, 2020 | May 15, 2020 |

| Mar 31, 2020 | $0.22563 | Apr 1, 2020 | Apr 15, 2020 |

| Feb 28, 2020 | $0.22515 | Mar 2, 2020 | Mar 13, 2020 |

| Jan 31, 2020 | $0.22515 | Feb 3, 2020 | Feb 14, 2020 |

| Dec 31, 2019 | $0.22031 | Jan 2, 2020 | Jan 15, 2020 |

| Nov 29, 2019 | $0.21982 | Dec 2, 2019 | Dec 13, 2019 |

| Oct 31, 2019 | $0.21982 | Nov 1, 2019 | Nov 15, 2019 |

| Sep 30, 2019 | $0.21982 | Oct 1, 2019 | Oct 15, 2019 |

| Aug 30, 2019 | $0.21934 | Sep 3, 2019 | Sep 13, 2019 |

| Jul 31, 2019 | $0.21934 | Aug 1, 2019 | Aug 15, 2019 |

| Jun 28, 2019 | $0.21934 | Jul 1, 2019 | Jul 15, 2019 |

| May 31, 2019 | $0.21885 | Jun 3, 2019 | Jun 14, 2019 |

| Apr 30, 2019 | $0.21885 | May 1, 2019 | May 15, 2019 |

| Mar 29, 2019 | $0.21885 | Apr 1, 2019 | Apr 15, 2019 |

| Feb 28, 2019 | $0.21837 | Mar 1, 2019 | Mar 15, 2019 |

| Jan 31, 2019 | $0.21837 | Feb 1, 2019 | Feb 15, 2019 |

| Dec 31, 2018 | $0.21401 | Jan 2, 2019 | Jan 15, 2019 |

| Nov 30, 2018 | $0.21353 | Dec 3, 2018 | Dec 14, 2018 |

| Oct 31, 2018 | $0.21353 | Nov 1, 2018 | Nov 15, 2018 |

| Sep 28, 2018 | $0.21353 | Oct 1, 2018 | Oct 15, 2018 |

| Aug 31, 2018 | $0.21304 | Sep 4, 2018 | Sep 14, 2018 |

| Jul 31, 2018 | $0.21304 | Aug 1, 2018 | Aug 15, 2018 |

| Jun 29, 2018 | $0.21304 | Jul 2, 2018 | Jul 13, 2018 |

| May 31, 2018 | $0.21256 | Jun 1, 2018 | Jun 15, 2018 |

| Apr 30, 2018 | $0.21256 | May 1, 2018 | May 15, 2018 |

| Mar 29, 2018 | $0.21256 | Apr 2, 2018 | Apr 13, 2018 |

| Feb 28, 2018 | $0.21208 | Mar 1, 2018 | Mar 15, 2018 |

| Jan 31, 2018 | $0.21208 | Feb 1, 2018 | Feb 15, 2018 |

| Dec 29, 2017 | $0.20578 | Jan 2, 2018 | Jan 12, 2018 |

| Nov 30, 2017 | $0.2053 | Dec 1, 2017 | Dec 15, 2017 |

| Oct 31, 2017 | $0.2053 | Nov 1, 2017 | Nov 15, 2017 |

| Sep 29, 2017 | $0.2053 | Oct 2, 2017 | Oct 13, 2017 |

| Aug 30, 2017 | $0.20481 | Sep 1, 2017 | Sep 15, 2017 |

| Jul 28, 2017 | $0.20481 | Aug 1, 2017 | Aug 15, 2017 |

| Jun 29, 2017 | $0.20481 | Jul 3, 2017 | Jul 14, 2017 |

| May 30, 2017 | $0.20433 | Jun 1, 2017 | Jun 15, 2017 |

| Apr 27, 2017 | $0.20433 | May 1, 2017 | May 15, 2017 |

| Mar 30, 2017 | $0.20433 | Apr 3, 2017 | Apr 14, 2017 |

| Feb 27, 2017 | $0.20384 | Mar 1, 2017 | Mar 15, 2017 |

| Jan 30, 2017 | $0.20384 | Feb 1, 2017 | Feb 15, 2017 |

| Dec 29, 2016 | $0.1961 | Jan 3, 2017 | Jan 13, 2017 |

| Nov 29, 2016 | $0.19561 | Dec 1, 2016 | Dec 15, 2016 |

| Oct 28, 2016 | $0.19561 | Nov 1, 2016 | Nov 15, 2016 |

| Sep 29, 2016 | $0.19561 | Oct 3, 2016 | Oct 17, 2016 |

| Aug 30, 2016 | $0.19513 | Sep 1, 2016 | Sep 15, 2016 |

| Jul 28, 2016 | $0.19319 | Aug 1, 2016 | Aug 15, 2016 |

| Jun 29, 2016 | $0.19319 | Jul 1, 2016 | Jul 15, 2016 |

| May 27, 2016 | $0.19271 | Jun 1, 2016 | Jun 15, 2016 |

| Apr 28, 2016 | $0.19271 | May 2, 2016 | May 16, 2016 |

| Mar 30, 2016 | $0.19271 | Apr 1, 2016 | Apr 15, 2016 |

| Feb 26, 2016 | $0.19222 | Mar 1, 2016 | Mar 15, 2016 |

| Jan 28, 2016 | $0.19222 | Feb 1, 2016 | Feb 16, 2016 |

| Dec 30, 2015 | $0.18496 | Jan 4, 2016 | Jan 15, 2016 |

| Nov 27, 2015 | $0.18448 | Dec 1, 2015 | Dec 15, 2015 |

| Oct 29, 2015 | $0.18448 | Nov 2, 2015 | Nov 16, 2015 |

| Sep 29, 2015 | $0.18448 | Oct 1, 2015 | Oct 15, 2015 |

| Aug 28, 2015 | $0.18399 | Sep 1, 2015 | Sep 15, 2015 |

| Jul 30, 2015 | $0.18399 | Aug 3, 2015 | Aug 17, 2015 |

| Jun 29, 2015 | $0.18399 | Jul 1, 2015 | Jul 15, 2015 |

| May 28, 2015 | $0.18351 | Jun 1, 2015 | Jun 15, 2015 |

| Apr 29, 2015 | $0.18351 | May 1, 2015 | May 15, 2015 |

| Mar 30, 2015 | $0.18351 | Apr 1, 2015 | Apr 15, 2015 |

| Feb 26, 2015 | $0.18302 | Mar 2, 2015 | Mar 16, 2015 |

| Jan 29, 2015 | $0.18302 | Feb 2, 2015 | Feb 17, 2015 |

| Dec 30, 2014 | $0.17762 | Jan 2, 2015 | Jan 15, 2015 |

| Nov 26, 2014 | $0.17731 | Dec 1, 2014 | Dec 15, 2014 |

| Oct 30, 2014 | $0.17731 | Nov 3, 2014 | Nov 17, 2014 |

| Sep 29, 2014 | $0.17731 | Oct 1, 2014 | Oct 15, 2014 |

| Aug 28, 2014 | $0.17701 | Sep 2, 2014 | Sep 15, 2014 |

| Jul 30, 2014 | $0.17701 | Aug 1, 2014 | Aug 15, 2014 |

| Jun 27, 2014 | $0.17701 | Jul 1, 2014 | Jul 15, 2014 |

| May 29, 2014 | $0.17671 | Jun 2, 2014 | Jun 16, 2014 |

| Apr 29, 2014 | $0.17671 | May 1, 2014 | May 15, 2014 |

| Mar 28, 2014 | $0.17671 | Apr 1, 2014 | Apr 15, 2014 |

| Feb 27, 2014 | $0.17641 | Mar 3, 2014 | Mar 17, 2014 |

| Jan 30, 2014 | $0.17641 | Feb 3, 2014 | Feb 18, 2014 |

Realty Income is one of the few stocks that has been consistently paying dividends. This gives investors a lot of faith that the dividends will keep coming in on time every time.

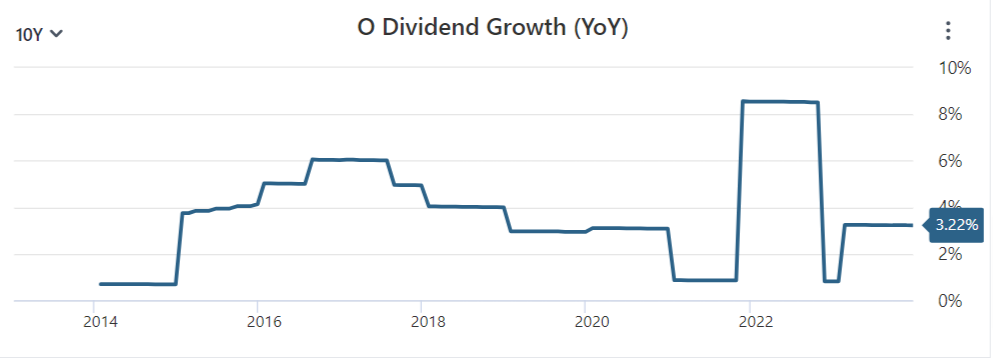

Realty Income gives investors a steady stream of passive income with currently 5.14% yield, which is more than double the average yield for the S&P 500. This makes it a great choice for retirement and other dividend investors. For investors, steady dividend growth over time has meant both a rising income stream and strong total gains from the stock.

Top-Notch Properties Leased to Recession-Resistant Retailers

Real Estate Income gets most of its rental income from retail buildings, mostly from pharmacies, dollar stores, and convenience stores. Even when the economy is bad, these businesses do well because people keep going there for everyday things.

Real Estate Income held more than 13,000 commercial properties in all 50 U.S. states, Puerto Rico, and the U.K. as of September 30, 2023. They also had 35 properties leased to Cineworld, which made up 1.1% of their total yearly contractual rent. It had 367 tenants in 64 different businesses, including Walgreens, 7-Eleven, Dollar General, FedEx, and other well-known companies in their fields.

Realty Income has very stable cash flow because most of its tenants are big, well-known companies that sell goods that won’t go out of style during recession. Its buildings also have an amazing 98.8% occupancy rate, which is much higher than the average for the sector and ensures that it makes the most money from rentals.

Major Acquisition Set to Unlock Significant Revenue and Cost Synergies

Realty Income said it would pay $9.3 billion to buy Spirit Realty Capital. The all-stock deal was announced on October 30, 2023. The combined company is projected to have an enterprise value of about $63 billion, which will increase Realty Income’s size, scale, and variety.

Realty Income will own more than 14,000 business properties that will be rented to 500 different companies after the deal is done. This huge variety of tenants, businesses, and locations further protects cash flows from tenants who don’t pay.

Also, Spirit Realty’s collection of high-quality, single-tenant properties rented by leaders in the industry goes well with Realty Income’s current assets. When the two businesses come together, they can save money and make more money, which will directly increase FFO per share by about $45 to $55 million a year.

For investors who want to make money, more funds from operations (FFO) per share means bigger dividends over time. So the purchase of Spirit Realty makes it possible for dividends to go up for many years to come.

Realty Income (NYSE: O) Outlook for 2024

Even though it had a small drop at the end of 2023, Realty Income spent most of last year beating its fellow REITs and larger stock market measures like the S&P 500. Investors didn’t seem to care that its cash sources were safe.

Inflation is going down, and the Federal Reserve may slow down on interest rate hikes later this year. This could make people feel better about the real estate market very quickly in 2024. That would probably cause Realty Income’s share price to rise, since it has been falling for no good reason.

When you add in the extra money from operations from the purchase of Spirit Realty, Realty Income looks like it will have huge total returns, thanks to both multiple growth and dividend payments.

If you’re an income investor looking for a very safe 5%+ yield and a price increase of probably 10%+ over the next 12 months, you might want to add this monthly-paying REIT to your portfolio.