Cryptocurrency has become a household term over the past few years, but most Americans still don’t fully understand it or feel confident investing in it.

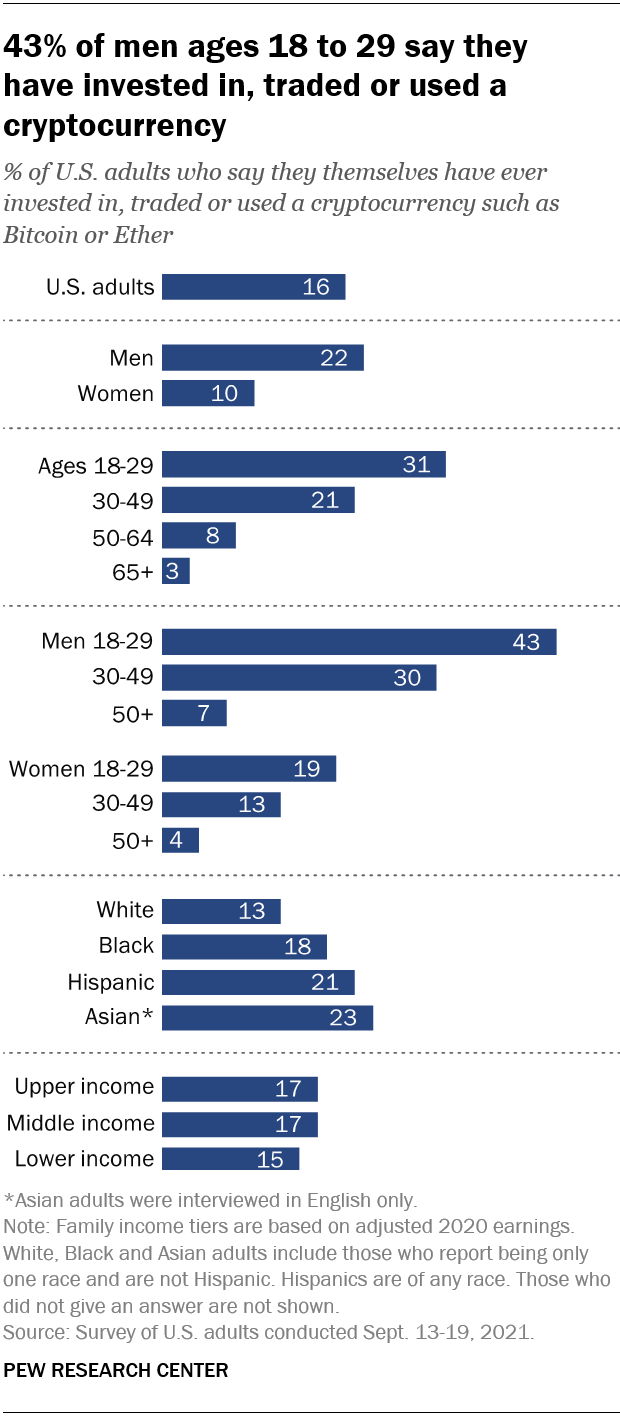

According to research from Pew, just 16% of U.S. adults have ever invested in, traded or used a cryptocurrency. Their wariness largely stems from concerns about volatility and the potential to lose money.

However, crypto offers a unique way to earn passive income for savvy investors who take the time to understand the market. It’s called crypto staking, and it allows you to earn rewards on your digital asset holdings without actively trading or speculating.

What Is Crypto Staking?

Staking centers around cryptocurrencies that use a “proof of stake” system to validate transactions. Instead of “mining” new coins, proof of stake blockchains get validators to stake existing coins to verify blocks.

The validators “lock up” a certain amount of their coins to participate in transaction validation. In exchange, they earn more of that cryptocurrency as a reward for their work.

It’s kind of like earning interest on a savings account. You agree to lock up a portion of your assets for a set period of time in return for interest earnings. With staking, your crypto holdings work for you and generate more holdings simply by remaining staked.

Why Staking Appeals to Investors

Crypto staking offers investors some key benefits:

- Passive income. Like earning interest, staking generates effortless passive income. Your staked crypto creates rewards around the clock just by remaining staked.

- No active trading. Staking does not require watching the markets or actively trading. Your staked assets earn rewards as long as they remain locked up.

- No speculation. Staking is not speculative like investing in crypto assets in hopes they’ll appreciate. The rewards are set and predictable.

- Helps secure blockchains. Staking helps verify transactions and provides security for proof-of-stake blockchains. So you earn rewards while supporting a project you believe in.

- No lock-in. Staked assets aren’t completely locked away forever. You can usually unstake at any time, though there is often a brief waiting period.

How Crypto Staking Works

Staking involves a simple process:

- Choose your assets. Decide which cryptocurrencies you want to stake. Popular staking coins include Ethereum, Cardano, Polkadot, Tezos and Cosmos.

- Select a staking pool. Most stakers join a staking pool rather than running their own validator node. Pools allow you to combine your staked assets with others to increase chances of validating blocks and earning rewards.

- Stake your assets. Deposit your crypto assets into the staking pool to fund your staked balance. Different coins require different minimum balances to begin earning staking rewards.

- Earn rewards. As your staked crypto participates in validating transactions, you’ll earn more of that coin proportional to the amount you’ve staked. Rewards accrue constantly and can be claimed or compounded.

- Manage and grow. Monitor your staking balance and the pool’s fees to maximize rewards. Add more assets to boost rewards. Withdraw anytime, with some delay, once you decide to stop staking.

Staking Reward Rates and Risks

The annual staking reward rate varies by asset and pools. Here are typical staking yields to expect:

- Ethereum – Up to 7.5%

- Cardano – Around 5%

- Polkadot – 8% to 15%

- Tezos – 5% to 7%

- Cosmos – 9% to 14%

As an investor though, you must weigh risks as well:

- Crypto volatility. Staked assets are still subject to market swings, and their value can decline even as you earn rewards.

- Smart contract bugs. Technical problems could put your staked assets at risk. Only stake on well-tested platforms with strong track records and security.

- Slashing. Some proof-of-stake chains punish validators who behave badly by “slashing” (confiscating) their staked coins.

- Staking lockups. Your crypto may be locked up for weeks or months after deciding to unstake, leaving you unable to sell during that time if needed.

Should You Stake Your Crypto in 2024?

Staking has grown increasingly popular because it lets cryptocurrency work for you. Instead of just holding it or trading it, your holdings provide rewards over time through staking. These unique benefits make staking worth considering for crypto investors in 2024:

- Healthy rewards. Staking pools can offer great returns compared to other investments like bonds, CDs, or high-yield savings. Expected yields of 5% to 15% beat most income options.

- Compound growth. Reinvesting staking rewards continually compounds your portfolio’s growth. Your staked balance and earning potential grow exponentially over time through compounding.

- Help secure networks. By staking, you help make proof-of-stake blockchains more secure while earning tokens of projects you want to support.

- Reduce volatility exposure. Staking can offset losses during bear markets. You earn staking yields even when your portfolio shrinks, and compounding boosts your holdings.

- Easy passive income. Staking requires no active management once set up. Your staked crypto earns rewards 24/7/365 with no extra effort from you.

Conclusion

Crypto staking lets digital currencies work for you. While still a new concept to most, it offers investors a smart way to generate effortless passive income. Staking provides rewards that compound over time with no trading or speculation required.

If you invest in cryptocurrency, strongly consider allocating 5% to 10% of your portfolio to staking. The passive yields can offset volatility and drive exponential growth through compounding. Staking returns easily beat conventional income options like bank accounts and bonds.

Of course, only stake assets on secure, proven platforms and understand the risks like any investment. But used properly, crypto staking lets your holdings work around the clock to build your wealth. It’s a strategy tech-savvy investors are sure to rely on more and more as staking platforms mature in 2024 and beyond.