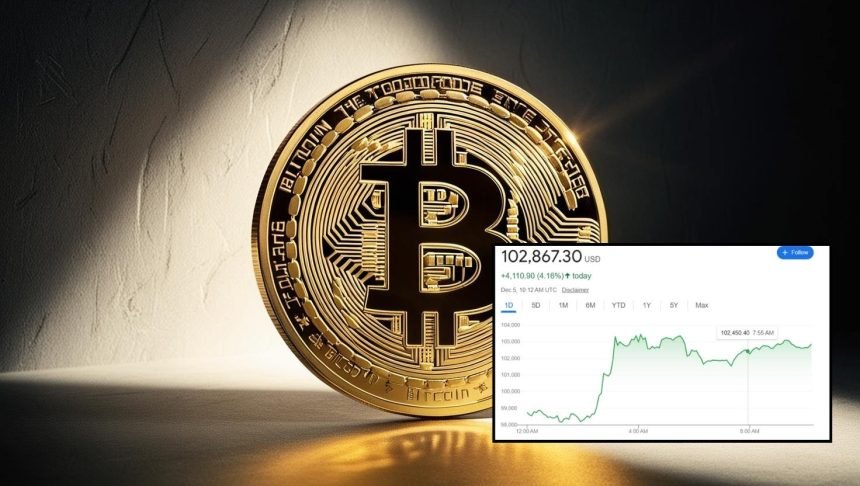

Bitcoin has shattered the $100,000 mark for the first time in its history, a dramatic rise that underscores the growing optimism surrounding digital assets, spurred by a mix of favorable regulatory signals and institutional interest.

The price of the cryptocurrency rose more than 6% in one day, reaching an all-time high of $103,619 on Thursday. Its market value is now close to $3.8 trillion, which is close to how much tech giants like Apple are worth all together.

This unprecedented rise happened after it was announced that Paul Atkins, a well-known supporter of cryptocurrencies, had been chosen by U.S. President-elect Donald Trump to lead the Securities and Exchange Commission (SEC).

The news has caused Bitcoin’s price to rise again and the cryptocurrency market as a whole to recover. Many experts have called the event a “paradigm shift” for the digital asset space.

Trump’s Vision and Paul Atkins: A New Era for Crypto Regulation

Trump’s choice of Atkins, a former SEC commissioner with strong libertarian views and a history of supporting digital assets, could be a turning point for regulation in the U.S.

The appointment of Atkins is seen as a sign that the new government will not be as involved in regulating the cryptocurrency industry. This could mean fewer enforcement actions and more support for new fintech ideas.

On the other hand, this is very different from how the Biden administration handled cryptocurrencies. They were more careful, especially after market volatility and well-known crashes like FTX in 2022.

A market researcher at Parataxis named Ed Chin was positive and said, “Whether it was Paul Atkins or someone else, as long as it isn’t the status quo.”

This change in how regulators feel about things is likely to lower the penalties for claimed violations. This could lead to more investment and growth in the sector.

Atkins has been very open about his support for cryptocurrencies. He is likely to play a key role in Trump’s larger plan to make the US a world leader in crypto innovation.

Atkins is a member of the Chamber of Digital Commerce and co-chair of the Token Alliance. He has a lot of experience writing rules that will help digital assets grow.

Trump has talked about making a national Bitcoin reserve, but experts are still not sure if such a big plan is possible, especially since he wants to keep the U.S. dollar as the world’s reserve currency.

But just bringing up these kinds of ideas has gotten a lot of people in the crypto world very excited.

Institutional Money Drives Bitcoin’s Meteoric Rise

Value of Bitcoin has more than doubled this year alone. This rise isn’t just due to speculation and small trades.

Before, institutional investors were wary of the risky cryptocurrency market, but now they are putting a lot of money into Bitcoin and other digital assets.

Analysts say that since Trump won the election, more than $4 billion has flowed into U.S.-listed Bitcoin exchange-traded funds (ETFs). This trend is likely to continue as Atkins takes over as head of the SEC.

Geoff Kendrick, who is the global head of digital assets research at Standard Chartered, pointed out that institutional buyers have bought about 3% of all Bitcoins in 2024 alone.

People think that this wave of institutional adoption is a big reason for Bitcoin’s meteoric rise and its becoming more common as an asset class.

According to Kendrick, digital assets are becoming backed by money. He said that Bitcoin futures, options, and ETFs have made it possible for more big companies to get into the market.

As these financial instruments gain traction, the cryptocurrency market is likely to become an integral part of standard financial markets, alongside currencies, commodities, and equities.

Wall Street’s Embrace of Crypto

Bitcoin has gone from being on the edges of the financial world to being right in the middle of Wall Street. The coin used to be seen as risky and unstable, but now it’s an important part of many institutional portfolios.

The fast rise of crypto-related stocks, such as those of Coinbase, Bitcoin miner MARA Holdings, and MicroStrategy, which have all seen big gains in the past few months, shows how people’s views have changed.

Mike Novogratz, the head of the cryptocurrency company Galaxy Digital, said, “Bitcoin and the whole ecosystem of digital assets are about to become mainstream in the financial world.”

He thinks that improvements in payments and tokenization, along with a clearer legal path, are pushing Bitcoin and other digital assets toward wider use by businesses.

A Resilient and Evolving Market

Bitcoin’s rise to six figures is an amazing comeback after a rough year in 2022, when the failure of the FTX exchange and a general drop in the prices of digital assets shook the cryptocurrency market.

But Bitcoin’s strength and the fact that more and more individual and institutional investors are starting to accept it suggest that the cryptocurrency has firmly established itself as a fixture in the global financial scene.

Even though there are worries about how cryptocurrency mining affects the environment and ongoing problems with crypto crime, people who support Bitcoin say that the fact that it is autonomous gives it a level of security and openness that traditional financial systems can’t match.

As the ecosystem for digital assets grows, Bitcoin is seen less and less as a speculative asset and more as a store of value like gold.

It could be used to protect against inflation and as a safer option to more traditional investments.

The Road Ahead

In the coming years, the cryptocurrency market is likely to keep going up. Bitcoin’s price could hit new highs as more institutional investors, clearer rules, and better technology drive growth.

But there are still problems to solve, such as the need for stronger security measures, more government oversight, and ways to deal with environmental issues.

There may be bumps on the way to widespread adoption, but Bitcoin is set to become a more important part of the global financial ecosystem thanks to people like Paul Atkins who will be shaping U.S. policy on digital assets and the growing number of institutional investors who are willing to bet on its long-term success.

We don’t know if Bitcoin will stay the leader in this field or if newer technologies will pass it, but for now, it’s clear that people are thrilled about reaching the $100,000 mark.