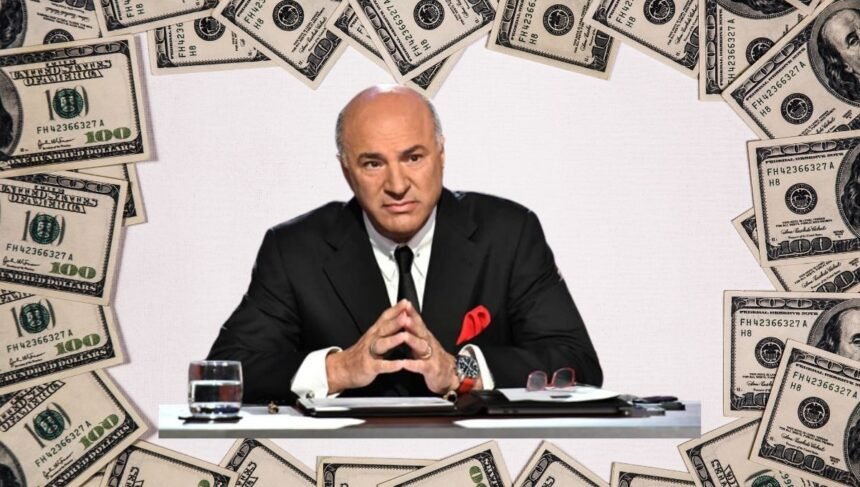

“You have to get to a place where you have $5 million in the bank,” Shark Tank star Kevin O’Leary declared in a popular YouTube video. With that amount earning 6-7% annual returns, he argues you’d have enough passive income to live comfortably for life.

For most people, amassing $5 million seems like an impossible feat. But O’Leary believes anyone can get there through smart investing, calculated risk-taking, and sheer determination to earn adequate compensation.

As someone with a personal net worth over $400 million, he’s put those principles into practice better than almost anyone. Here’s a look at O’Leary’s path to prosperity and his best tips for building your own seven-figure fortune.

The Math Behind O’Leary’s $5 Million Retirement Number

O’Leary’s $5 million target is based on the assumption that a 6-7% annual return would produce $300,000 to $350,000 in passive income every year. While financial advisers often recommend a more conservative 4% withdrawal rate in retirement planning, $300k would still provide over three times the median US household income.

“When you make that, you set it aside and don’t risk it,” O’Leary advises. “Then after that you can take risk capital and put it to work.”

Essentially, he says the first $5 million should be an untouchable nest egg that throws off plenty of cash flow for living expenses. Additional investing can be more aggressive in pursuit of greater wealth, but that baseline ensures your basic needs are covered if you have a stretch of bad luck.

Read More: Kevin O’Leary to Americans: “Stop Buying Coffee and Lunch Out – You’re Wasting Over $15K a Year”

O’Leary’s Tips for Getting to $5 Million

The Shark Tank star and Chairman of O’Leary Financial Group didn’t stumble into his immense fortune by accident. He credits these strategies for his success:

1. Take Calculated Risks

“I like to take risks. That’s how I make money,” O’Leary proclaims. “But they are calculated risks.”

He believes venturing into the unknown is necessary to get outsized returns, but only with thorough research and understanding of what you’re getting into. O’Leary studies companies exhaustively before investing to gauge the upside potential and downside risks.

2. Bet on Yourself

The majority of O’Leary’s wealth has come from founding and investing in his own businesses. He urges others to do the same if they have the skills and work ethic required.

“Bet on yourself, take the risk, work weekends and off hours,” he says. O’Leary warns that playing it safe rarely leads to real prosperity. Taking a chance on your own great idea could be the key.

3. Focus on Cash Flow

In O’Leary’s view, reliable cash flow matters more than chasing elusive growth stocks when building wealth.

“I like dividends, I like rents, I like interest rate yields—that’s how I’ve made my money,” he notes. His goal is always to acquire quality assets producing income month after month.

4. Get Paid What You Deserve

“The wealthiest people I know are usually the cheapest people I know,” O’Leary muses. “They get rich because they’re not afraid to ask for what they want.”

He says the hyper-successful tend to negotiate firmly and aren’t shy about demanding fair compensation for their efforts. Following that lead can help maximize your earnings over time.

5. Vet Opportunities Rigorously

Over his long career, O’Leary figures he’s evaluated tens of thousands of investment deals. “Truth be told, most of them sucked,” he admits.

His advice is not to get caught up in hype or fear of missing out. Whether it’s a hot stock, new venture capital investment, or intriguing business idea, O’Leary prescribes asking tough questions and trusting your instincts. If something seems too good to be true, it probably is.

Real-Life Examples of O’Leary’s Strategies Paying Off

O’Leary has taken big swings and hit home runs over the years by following his own advice:

In 1986, he founded SoftKey Software Products, a tech company that acquired and distributed popular software and games aimed at the growing home PC market. After a merger and eventual sale to Mattel, O’Leary pocketed a reported $6 million windfall.

In 2003, he co-founded Storage Now Holdings, a climate-controlled storage company that has grown to 65 locations across Canada. As Chairman, O’Leary continues overseeing its expansion and cash flow.

O’Leary has made hundreds of venture capital investments through the years too, both solo and as a longtime Shark on ABC’s business reality show. Some of his biggest scores came from betting early on companies like WazEagle Technology Group (video conferencing) and Acton Skates (premium skate manufacturer).

And despite the risk associated with cryptocurrency, O’Leary allocated 3% of his portfolio to Bitcoin and Ethereum in 2021 after much due diligence. “I understand why blockchain works now,” he told CNBC. So far that wager has paid off nicely.

Key Takeaways from O’Leary’s Wealth-Building Formula

While emulating everything Kevin O’Leary does would be an extremely tall order, incorporating aspects of his strategy makes good financial sense for many:

- Save and invest early and often with an eye toward passive income streams

- Take carefully-calculated risks in pursuit of game-changing returns

- Negotiate fair compensation for your contributions and never sell yourself short

- Scrutinize every new opportunity thoroughly before moving forward

- Once you have a nest egg that supports your lifestyle, shift focus more toward capital growth

Executing this blueprint demands patience, diligence, business savvy, and the willingness to think big. O’Leary proves that for those truly committed, however, the monetary rewards can be immense. Whether your number is $5 million or something more (or less) ambitious, his advice offers a tested path toward getting there.