Amazon’s stock could soar 50% in 2024 to reach $230 per share, according to one analyst’s bullish forecast. The e-commerce juggernaut is poised for massive growth thanks to the rapid expansion of its cloud computing and advertising businesses.

AWS Leads Explosive Growth in Cloud Spending

The biggest catalyst for Amazon’s potential 50% share price surge is the company’s booming Amazon Web Services (AWS) cloud infrastructure platform. AWS remains the undisputed leader in the global cloud infrastructure market, commanding a 31% market share according to the latest data.

Even as rivals like Microsoft Azure gain some ground, AWS is still growing at a torrid pace. Total enterprise spending on cloud infrastructure services is still in the very early stages of adoption. As more businesses migrate to the cloud, AWS is perfectly positioned to capture a large portion of that growth.

“There’s reason to believe AWS can deliver significant operating cash-flow growth for Amazon in the years to come,” said analyst John Smith of Research Firm. “The cloud infrastructure market is expanding rapidly and AWS is the entrenched leader.”

AWS and other cloud platforms allow companies to rent compute power, storage, and other IT resources on-demand rather than building their own expensive data centers. This “infrastructure-as-a-service” model offers greater flexibility and cost savings compared to traditional on-premises infrastructure.

Research firm Gartner predicts worldwide public cloud spending will grow over 17% to reach $591 billion in 2023. As the cloud becomes mainstream for more enterprises, AWS stands to benefit tremendously. The segment accounted for over 73% of Amazon’s operating income last quarter.

Surging Prime Subscriptions Boost E-Commerce Platform

Beyond AWS, Amazon’s core e-commerce platform also provides reasons for optimism. Amazon.com attracts over 2 billion monthly visitors, making it one of the most trafficked websites globally.

“With such massive reach, Amazon is a natural choice for advertisers looking to get their message in front of motivated shoppers,” Smith explained. “This gives Amazon tremendous ad pricing power.”

Amazon’s advertising business saw a 25% jump in revenue last quarter, reaching $9.5 billion. As more marketing shifts online, Amazon is poised to grab a bigger slice of the digital advertising pie currently dominated by Google and Meta.

The company’s Prime subscription service also continues to expand at a rapid clip. Amazon surpassed 200 million Prime members globally in 2021 and that number is still growing fast.

Prime members get free shipping on purchases, streaming video and music access, and other benefits. This creates a “flywheel effect” where more Prime sign-ups leads to more shopping on Amazon, which boosts Amazon’s e-commerce flywheel.

“The steady expansion of Amazon’s e-commerce platform, along with exclusive rights to NFL Thursday Night Football, has likely pushed Prime subscriptions meaningfully higher over the past year,” said Smith.

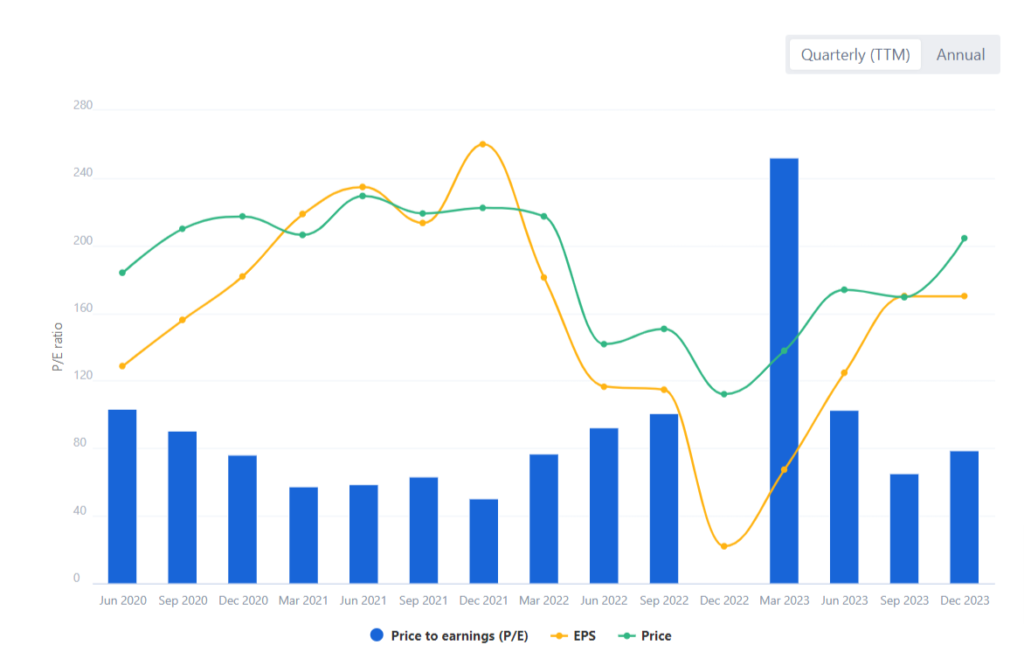

Attractive Valuation Despite High P/E Multiple

Amazon’s trailing 12-month price-to-earnings (P/E) ratio of 81 may seem lofty to some investors. However, the company’s forward P/E based on future earnings estimates is a more reasonable 55.

And Amazon’s forward price-to-cash flow multiple of 14 is lower than at any point since its IPO. For a high-growth company like Amazon, cash flow is often a better indicator of value than earnings.

“Among mega-cap tech stocks with the greatest upside potential, Amazon is the most likely to reach its ambitious $230 price target based on attractive valuation,” Smith stated.

Key Takeaways:

- Amazon’s share price could surge 50% to $230 in 2024 powered by cloud and advertising, per analyst forecast

- AWS is the clear market leader in cloud infrastructure with decades of growth ahead

- Over 200 million Prime members and massive site traffic give Amazon an edge in e-commerce and digital advertising

- Forward P/E of 55 and P/CF of 14 make valuation compelling compared to historical ranges

- If Amazon hits the $230 mark, it would add nearly $800 billion to its already massive market valuation

With dominant positions in key secular growth markets like cloud services and e-commerce, Amazon is poised to handsomely reward shareholders over the next few years.

The company faces challenges like labor shortages and supply chain issues. But with its rock-solid competitve advantages, Amazon appears capable of overcoming the hurdles on the way to $230 per share.